Procurement and Trading Strategies

Enhance your trading edge & optimize your procurement strategy with unique geospatial alpha

Transparent

prescriptions

2–5%

annual savings

Configurable

custom procurement & hedging schedule

AI-informed hedging and trading

Commodity futures strategies

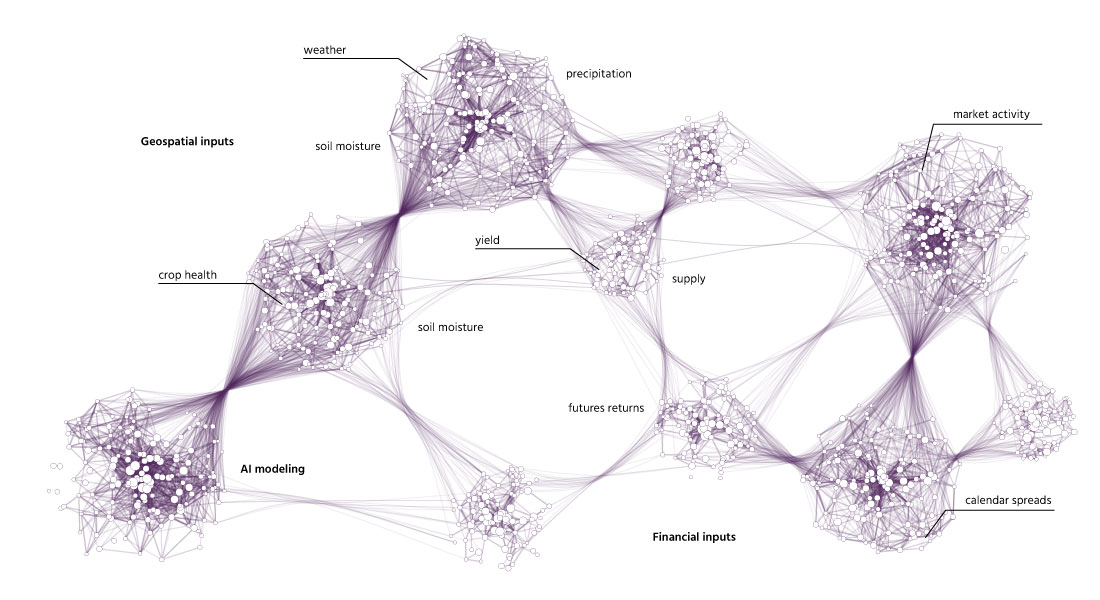

Revolutionary deep learning models, fueled by geospatial data, recognize complex patterns and signals to enhance your strategy and inform exclusive market insights.

Unparalleled price forecasting, powered by deep learning and AI.

Commodity markets are intrinsically connected to patterns on the Earth. Integrate price forecasts built on deep learning models into your decision-making to gain an operational advantage.

For hedging & procurement

Protect your supply chain against increasingly volatile commodity prices while managing risk exposure with our clear, configurable buying strategies that best meet your business needs and risk parameters.

The Descartes Labs Procurement Strategy employs forecasts of multiple horizons to generate a forecast trajectory of prices faced during the entire procurement period. It gives Commodity Risk or Procurement Managers, and those in a direct procurement role, the advantage to lock in purchases of required input to their final good at the lowest price (relative to competitors or their given benchmark).

Descartes Labs has demonstrated a track record of savings for our clients, which can significantly impact consistency of earnings, facilitate budget/planning and deliver consistent procurement cost savings.

Product features

A daily purchasing report including:

- A clear prescription of actions recommended by the model.

- A per-quota-month breakdown of forecast price evolution, benchmark purchasing period price and strategy lock-in to facilitate trust in our strategy’s prescriptions.

- Transparency into driving factors behind price changes.

Configurable features include quota, purchasing/hedging schedule, specific contracts, purchasing/benchmark periods, and daily caps/floors on quantities.

Highlights

Consistent cost savings

Significantly impact cost savings with strategies informed by proprietary geospatial data. Enhanced with machine and human intelligence, our insights empower you with clear actionable recommendations.

Actionable Insights

Mitigate the impact of price volatility and achieving optimal savings with smart procurement or hedging programs. Daily actionable and clear prescriptions for optimal strategy performance.

Impressive Savings

Drive ROI with a proven track record of 2-5% annual savings, including available history for your team to backtest.

High-accuracy Forecasting

Strategize with methodology informed by financial, positioning inputs as well as inputs from our library of increasingly essential earth-observation signals.

For trading and investments

Our innovative Trading Strategy Package is meticulously designed to empower you with the edge you need to navigate the intricacies of financial markets.

Powered by a specific horizon forecast from our Quantitative Price Forecasts Product library, this product provides:

- Clear actionable reports provided daily:

- Position level prescriptions to know precisely when to enter and exit/stop-out a position and the strategy’s reasoning.

- Target entry prices and the strategy’s current view, given the price forecast, of the exit date.

- Running tabs on the P&L by order, by contract, and in aggregate

- Risk management capabilities - trailing stops or stops based on cumulative price moves, position limits.

- Transparency into driving features behind the price forecast evolution

- Alpha driven by features from a broad library of forecasts in the logistics/supply-chain, agriculture/industrial production, weather, and human activity. These features are combined with financial market signals (like price, trading action and positioning data) from the futures and options markets.

Our strategies are built on a solid foundation of extensive market research and data analysis. It has been rigorously tested across various market conditions to ensure reliability and effectiveness. These backtests are also available to you for independent verification.*

Product features

A daily trading strategy report including:

- An overview of running Profit & Loss for the strategy compared with initial Profits & Loss

- Clear statement of model recommendation for orders to execute (open/close, long/short, quantity)

- Tracking at both contract level and position/order level (including size of position, direction, entry date and price, target exit date and price

- Transparency into driving factors behind price forecast changes

- Ability to include position limits and stop loss guardrails into strategy

Highlights

Optimize trading profit

Superlative strategies for your trades with pricing forecasts, actionable insights, transparent prescriptions, and proven savings.

Unique geospatial insights

Translate geospatial edge into actionable prescriptions for your trading team with daily trade strategies that optimize profit.

Proven savings

Drive ROI with a proven track record of 2-5% annual savings as a result of our high-accuracy forecasting models informed by both financial, positioning inputs, along with our proprietary earth-observation data insights.

Fully transparent

Independently backtest with full model and strategy transparency with a comprehensive history of strategy.

Product specs

Daily insights, delivered.

Product Delivery

Recommendations delivered daily to your inbox with supplemental data packages containing relevant feature contributions, historical forecasts, and backtest data.

Procurement Specs

Clear trade action recommended by model including quota amount to purchase and model forecast price for that day as well as the price at which the model is expecting execution. Includes history of strategy performance against benchmark.

Visualization

An interactive dashboard that enables users to drill down into the performance and prediction strategy as of prior historical dates.

Trading Specs

Continuous tracking of Profit & Loss, sent late evening prior to date of applicability to enable users to take action on the recommendation.

*Trading involves risk and past performance is not indicative of future results. The information and prescriptions provided by our strategy should be used as a tool to assist your trading decisions and not as a guarantee of profits. Please ensure you understand the risks associated with trading and only invest what you can afford to lose.

Gain a market advantage with AI-informed

commodity insights and strategies.

Talk to an expert to learn how Descartes Labs can grow your business.